Marital Funds Distribution in NC: What You Need to Know 2026

Understand marital funds distribution in North Carolina. Call Vasquez Law Firm for a free consultation to protect your rights in divorce cases.

Vasquez Law Firm

Published on February 5, 2026

Marital Funds Distribution in NC: What You Need to Know 2026

Marital funds distribution is a crucial part of divorce proceedings in North Carolina. In 2026, understanding how marital and non-marital property is divided can protect your financial future. This guide explains the equitable distribution process, what properties are considered marital, and the steps to take in Raleigh with help from Vasquez Law Firm. Whether you have retirement accounts, premarital property, or joint assets, knowing your rights can make a significant difference during divorce.

Need help with your case? Our experienced attorneys are ready to fight for you. Se Habla Español.

Schedule Your Free Consultation

Or call us now: 1-844-967-3536

Quick Answer

Marital funds distribution in North Carolina divides assets and debts acquired during marriage fairly but not always equally. The court looks at factors like premarital ownership and contributions to decide how property is split during divorce.

- Marital property includes assets acquired during marriage.

- Separate property generally stays with its owner.

- Equitable distribution balances fairness, not strict equality.

- Retirement accounts and debts are also part of the process.

- Legal help is crucial to protect your rights.

Understanding Marital Funds Distribution

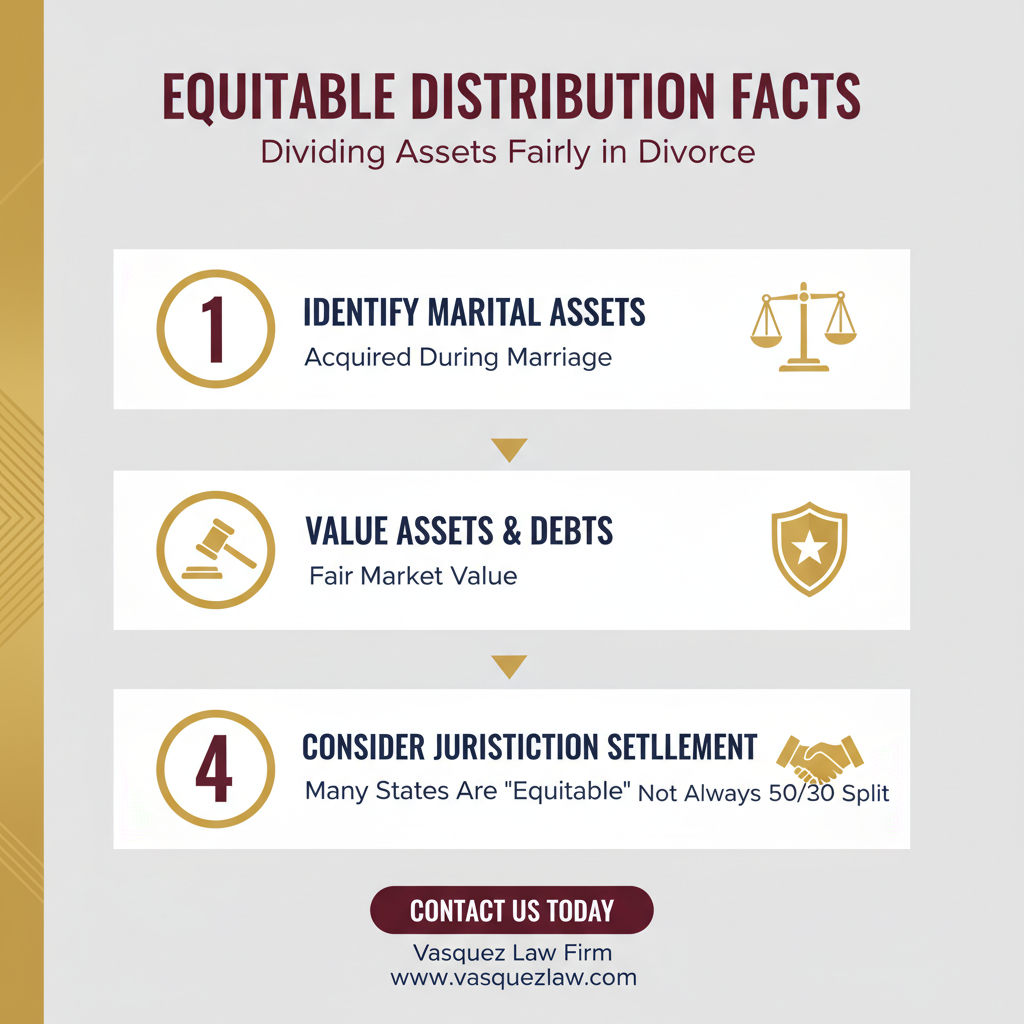

Marital funds distribution refers to how money and assets earned or acquired during a marriage are divided during a divorce. In North Carolina, the court follows the equitable distribution principle, which means the division must be fair but not necessarily equal. This distinction is important because it recognizes that some assets or debts may rightfully stay with one spouse or be divided unevenly, depending on the circumstances.

Equitable distribution applies to everything from real estate and bank accounts to retirement funds and debts. For example, if one spouse owned a home before marriage that remained separate, that property may not be split unless its value increased due to marital efforts.

Knowing which funds are considered marital and which are separate or non-marital significantly affects the outcome. Marital funds generally include:

- Income earned by either spouse during the marriage

- Property purchased or acquired during marriage

- Retirement contributions made during marriage

- Debts accumulated during the marriage

Separate property usually means assets owned before the marriage, inheritances, or gifts given only to one spouse. However, if those assets were mixed with marital funds, the classification may change through a process called "commingling." This issue often complicates marital funds distribution.

Marital Funds and Retirement Accounts

Retirement accounts, including 401ks and pensions, are often complicated components of marital funds distribution. If contributions were made during the marriage, courts typically consider the portion earned during marriage as marital property. However, premarital balances may remain separate property. Specialized legal tools like Qualified Domestic Relations Orders (QDROs) may be necessary to divide retirement funds correctly.

Legal Framework and Statutes

The North Carolina General Statutes Chapter 50, especially sections 50-20 and 50-21, govern equitable distribution. These laws set guidelines for identifying, valuing, and dividing marital property while giving judges discretion to ensure fairness.

Why It Matters in Raleigh

Local courts in Raleigh apply North Carolina equitable distribution laws with attention to each couple's unique situation. Understanding how marital funds distribution works in Raleigh will help you better prepare for divorce negotiations or court proceedings. Working with an experienced family law attorney can protect your interests and clarify this complex process.

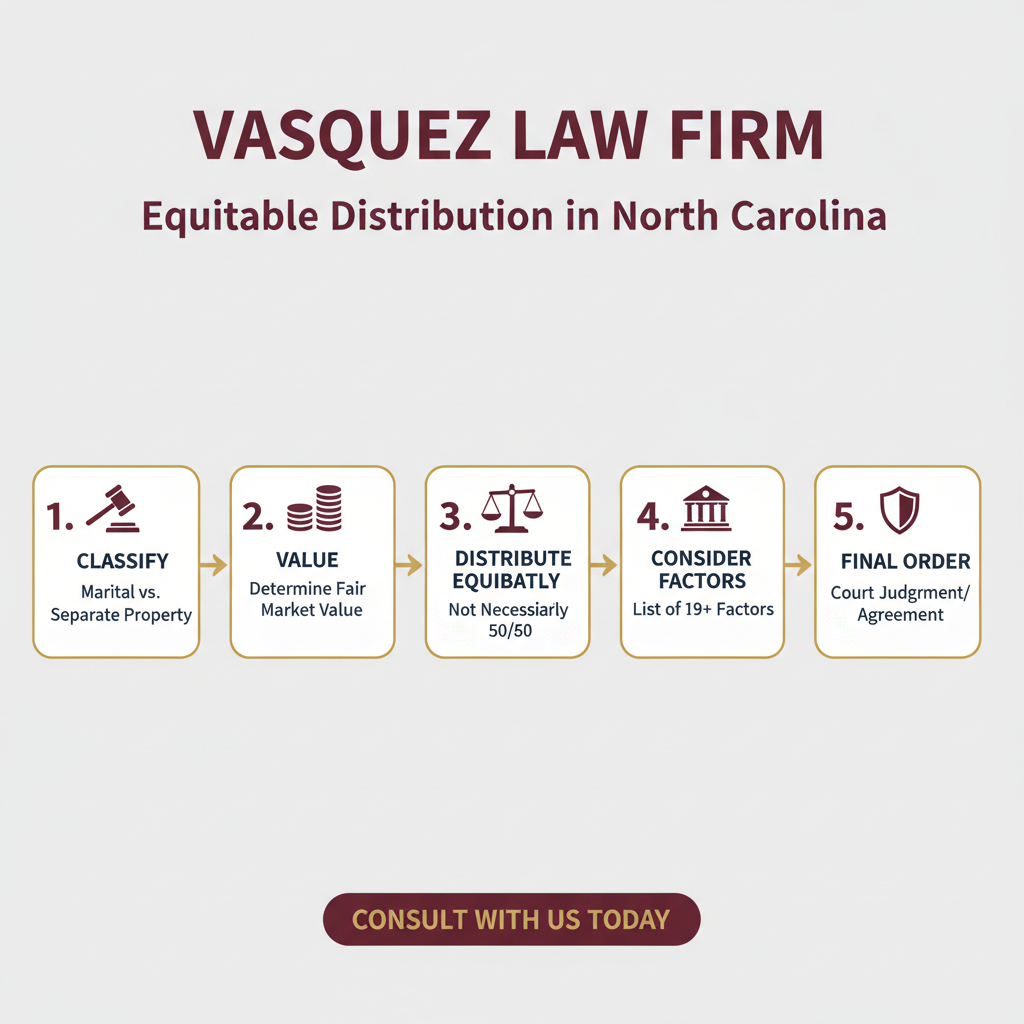

Step-by-step: What to do

- Gather Financial Documents: Collect bank statements, pay stubs, tax returns, retirement account details, property deeds, and debt records.

- Identify Marital vs Separate Property: Determine which assets and debts are marital and which are separate using legal definitions and your financial history.

- Use the N.C. Equitable Distribution Worksheet: This worksheet assists in itemizing and valuing assets and debts for a clear overview.

- Negotiate a Settlement: Attempt to reach an agreement with your spouse on how to divide marital funds fairly, often with attorney help or mediation.

- File in Court if Needed: If settlement is not possible, the court will review evidence and decide on equitable distribution.

- Follow Court Orders and Finalize Divorce: Ensure property division complies with court orders and update titles or accounts accordingly.

- Consider Post-Divorce Adjustments: In some cases, petitions for adjustments under N.C.G.S. 50-21 can be filed if circumstances change.

Checklist of Financial Documents

- Bank and investment account statements

- Credit card and loan statements

- Deeds for real property

- Retirement account statements (401k, IRA, pensions)

- Tax returns from recent years

- Pay stubs or proof of income

- Documentation of inheritances or gifts

Common mistakes and how to avoid them

- Failing to Document Assets: Always gather and organize financial records early. Missing evidence weakens your position.

- Assuming All Assets Are Marital: Understand what counts as separate property to avoid unjust claims.

- Ignoring Debts: Marital debts matter as much as assets and must be accounted for fairly.

- Not Seeking Legal Help Early: Family law attorneys can protect your rights and guide negotiations.

- Accepting Unfair Agreements under Pressure: Take time to review offers; do not rush just to settle quickly.

- Overlooking Retirement Accounts: These require specialized handling—missing out can reduce future financial security.

- Disregarding State-Specific Rules: North Carolina laws can differ from other states. Local knowledge is crucial.

If you only remember one thing: Marital funds distribution is complex. Professional legal advice is key to protecting your fair share.

Timeline: What to expect

- Weeks 1-2: Begin collecting financial documents and meet with an attorney.

- Weeks 3-4: Identify and categorize marital vs separate property. Start negotiation discussions.

- Month 2-3: Attempt mediation or settlement talks to divide assets amicably.

- Month 3-6: If no agreement, prepare for court hearings where distribution decisions are made.

- Month 6-9: Receive court order for property distribution. Implement transfers or payments.

- Post-Divorce: Review for possible adjustments under N.C.G.S. 50-21 if circumstances change significantly.

Costs and fees: What impacts the price

- Complexity of financial situation affects lawyer fees.

- Length of negotiation or litigation changes total costs.

- Mediation can reduce expenses compared to court trials.

- Document preparation, valuation experts, and related services add to cost.

- More contested cases require more attorney time and greater expense.

NC, FL, and nationwide notes

North Carolina notes

North Carolina follows equitable distribution under N.C.G.S. §§ 50-20 and 50-21. Courts consider many factors including contributions by each spouse, duration of marriage, and economic circumstances.

Florida notes

Florida uses similar equitable distribution principles but community property states differ. In Florida, marital funds distribution also considers factors such as economic misconduct. Consultation with a local attorney is critical for accuracy.

Nationwide concepts (general only, rules vary)

Across the U.S., divorce asset division laws vary between equitable distribution and community property states. Federal law generally does not govern property division unless federal benefits or retirement accounts are involved. Always consult state-specific laws.

When to call a lawyer now

- If sizable assets or retirement accounts are involved.

- If one party is hiding income or assets.

- If you are unsure which property is marital or separate.

- If your spouse has already filed divorce papers.

- If debts are large or disputed between spouses.

- If you want to negotiate a fair settlement instead of litigating alone.

- If you have questions about post-divorce adjustments.

- If domestic violence or coercion affects negotiations.

- If mediation or settlement attempts have failed.

- If you need help understanding complex financial documents.

About Vasquez Law Firm

At Vasquez Law Firm, we combine compassion with aggressive representation. Our motto "Yo Peleo" (I Fight) reflects our commitment to standing up for your rights.

- Bilingual Support: Se Habla Español - our team is fully bilingual

- Service Areas: North Carolina, Florida, and nationwide immigration services

- Experience: Over 15 years helping clients navigate complex legal matters

- Results: Thousands of successful cases across multiple practice areas

Attorney Trust and Experience

Attorney Vasquez holds a Juris Doctor degree and is admitted to practice in both the North Carolina State Bar and Florida Bar. With over 15 years of dedicated legal experience, he has built a reputation for providing personalized attention and achieving favorable outcomes for his clients.

Don't wait to get the help you deserve. Call us now for immediate assistance.

Se Habla Español

Frequently Asked Questions

Is my spouse entitled to half my 401k in a divorce?

In North Carolina, retirement accounts like 401k plans are often considered marital property if contributions were made during the marriage. The court uses equitable distribution to divide these accounts fairly, which does not always mean a straight 50/50 split. The division depends on factors such as when the funds were contributed and any premarital balances.

What money can't be touched in a divorce?

Generally, assets that are separate property, such as inheritances received by one spouse or property owned before the marriage, are not subject to division in a North Carolina divorce. However, commingling or use of those assets during the marriage may affect their status. Each case is unique, so legal advice is essential.

What is the definition of marital funds?

Marital funds refer to the money and assets acquired during the marriage. This includes income, savings, property, and investments gained while married. Marital funds are subject to equitable distribution during divorce unless a valid agreement states otherwise.

Is my spouse entitled to half of everything?

North Carolina uses equitable distribution, which means assets are divided fairly, not necessarily equally. The court considers factors like each spouse’s financial situation, contributions, and future needs. So, your spouse is not automatically entitled to half of everything.

What happens to property owned before marriage in NC?

Property owned before marriage is generally considered separate property and not subject to division. However, if that property increased in value due to marital efforts or was mixed with marital assets, it might be partially considered marital property in equitable distribution.

What is an interim distribution in NC?

An interim distribution is a temporary allocation of marital funds or property before the final divorce order. It helps spouses meet financial needs during the divorce process. Courts may grant interim distributions based on current circumstances to maintain fairness.

How does the N.C. Equitable Distribution Worksheet work?

The N.C. Equitable Distribution Worksheet helps courts calculate the fair division of marital property. It itemizes assets and debts and assigns values to assist in an equitable split. Though not binding, the worksheet provides a clear framework for judges.

Are there time limits for filing for equitable distribution in NC?

Yes. In North Carolina, a claim for equitable distribution must generally be filed within two years after the date of separation or within the timeframe set by the divorce proceedings. Missing deadlines can affect your rights, so early legal help is important.

Sources and References

Take the first step toward justice today. Our team is standing by to help.

Start Your Free Consultation Now

Call us: 1-844-967-3536

Se Habla Español - Estamos aquí para ayudarle.

Free Legal Consultation

Discuss your case with our experienced attorneys. We're available 24/7.

Vasquez Law Firm

Legal Team

Our experienced attorneys at Vasquez Law Firm have been serving clients in North Carolina and Florida for over 20 years. We specialize in immigration, personal injury, criminal defense, workers compensation, and family law.