Marital Funds: Essential Guide to Understanding in 2026

Learn what marital funds mean in Florida and North Carolina in 2026. Understand your rights and schedule a free consultation with Vasquez Law Firm today.

Vasquez Law Firm

Published on February 8, 2026

Marital Funds: Essential Guide to Understanding in 2026

Marital funds refer to the money and assets accumulated during a marriage that can be subject to division in divorce proceedings. In 2026, understanding how marital funds are defined and distributed in both Florida and North Carolina is critical for anyone facing divorce or family law issues. This comprehensive guide explores the legal definition of marital funds, how courts determine what qualifies as marital property, and key distinctions between marital and separate funds. Learn the steps to protect your financial rights and navigate marital funds disputes with confidence. Whether you're in Orlando or North Carolina, this article explains the essential facets of marital funds to help you make informed decisions.

Need help with your case? Our experienced attorneys are ready to fight for you. Se Habla Español.

Schedule Your Free Consultation

Or call us now: 1-844-967-3536

Quick Answer

Marital funds are assets and money acquired during a marriage that courts consider for division in divorce cases. The definition and division can vary between Florida and North Carolina but generally include income, property, and accounts gained while married. Knowing what counts as marital funds is key to protecting your financial interests.

- Includes income, real estate, retirement accounts earned during marriage

- Separate property owned before marriage is usually excluded

- Courts apply equitable distribution principles, which differ by state

- Dissipation of funds can impact division outcomes

- Proper documentation strengthens your case

What Are Marital Funds and Why They Matter

Marital funds refer to the money and assets accumulated during the course of a marriage that may be subject to division upon divorce. This includes all forms of income, property, savings, investments, and benefits obtained by either spouse while married. It is important to recognize that marital funds do not simply mean cash in a joint bank account; it also covers various asset forms such as retirement accounts, real estate, and even appreciation in certain non-marital property.

Understanding marital funds is critical in divorce or family law cases, especially in states like Florida and North Carolina where property division is governed by equitable distribution laws rather than automatic equal division. Equitable distribution means courts aim for fairness, not necessarily a 50/50 split. The definition of what counts as marital funds affects how assets are divided and can have a significant impact on the final settlement.

Whether you or your spouse earned the funds or held legal title, if the asset was acquired during the marriage, it is most likely marital property. Courts also evaluate if separate property increased in value during marriage because of marital funds or efforts, which influences what is considered marital funds. This distinction is pivotal when negotiating or litigating property division, helping parties understand their rights and financial stakes.

Common Types of Marital Funds

- Salary and wages earned during marriage

- Real property purchased with marital income

- Retirement plans or pensions accumulated during marriage

- Business interests started or expanded during marriage

- Investment income and savings accrued during marriage

Why It Matters in Divorce

Recognizing which funds are marital is the foundation of property division. You can better protect your share by identifying marital funds early and gathering evidence to prove ownership or separate property distinctions. This understanding also informs settlement talks or court proceedings, reducing surprises and helping parties reach fair agreements.

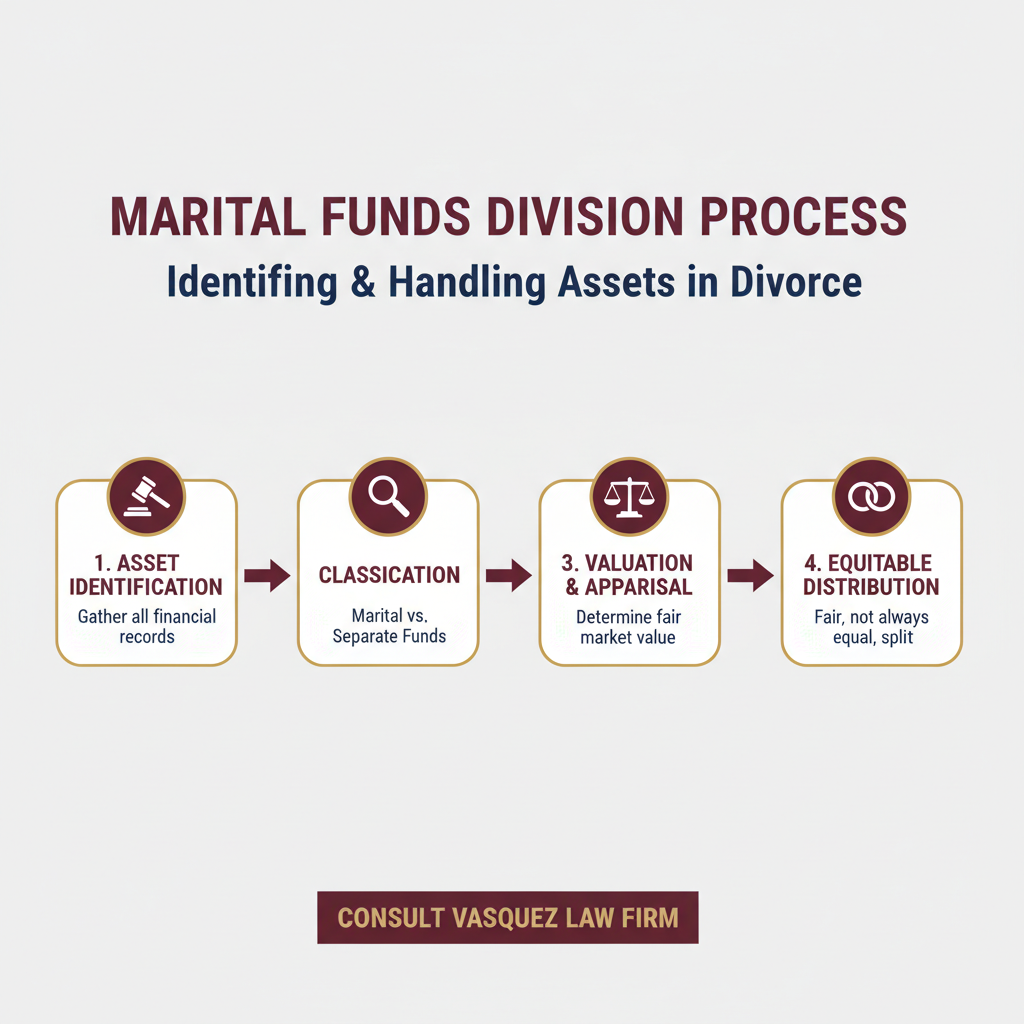

Step-by-Step: How Marital Funds Are Determined

Determining marital funds involves several legal and practical steps designed to distinguish marital property from separate property and evaluate how funds were accumulated during marriage. Following a systematic approach improves clarity and fairness.

- Gather Financial Records: This includes bank statements, tax returns, investment accounts, property deeds, and retirement plan documents.

- Identify Acquisition Dates: Determine when assets were acquired to establish if they fall within the marriage timeframe.

- Classify Property: Separate property, such as gifts or inheritance received before or during marriage, is identified and distinguished from marital funds.

- Assess Appreciation: For separate property, evaluate if the asset’s value increased due to marital funds or effort, such as property improvements during marriage.

- Calculate Marital Portion: Calculate the share that qualifies as marital based on contributions and appreciation.

- Consider Dissipation: Investigate if any marital assets were wasted or hidden, which impacts distribution.

- Engage in Negotiations or Litigation: Parties attempt to divide marital funds fairly. If agreement fails, the court decides based on evidence and law.

Step 1: Gather Financial Records

Start by collecting all financial documents that show income and asset accumulation during marriage. These documents may be requested during discovery in divorce proceedings. Organized records directly support your claims regarding marital funds.

Step 2: Classify Property

Property owned before marriage, inheritances, and gifts are usually separate property but should be documented carefully. Courts may reclassify certain assets based on how marital funds impacted them.

Step 3: Calculate and Negotiate

With clear classification, parties and their attorneys negotiate a fair division. Understanding these steps helps reduce conflict and protect your interests efficiently.

Documents and Evidence Checklist for Marital Funds Cases

- Salary and wage statements (pay stubs, W-2 forms)

- Bank and investment account statements

- Retirement and pension plan statements

- Deeds and titles for real estate and vehicles

- Tax returns for the years of marriage

- Gift and inheritance documentation

- Business ownership and valuation reports

- Canceled checks for large purchases

- Credit card and loan statements

- Correspondence or affidavits relating to asset management

Timeline: What to Expect in Marital Funds Distribution

- Weeks 1-2: Initial consultation and case review with attorney.

- Weeks 3-6: Gather financial documents and exchange disclosures.

- Weeks 7-10: Analysis and classification of marriage assets and debts.

- Weeks 11-14: Negotiations or mediation to divide marital funds.

- Weeks 15-20: If no agreement, court hearings and trial preparation.

- Weeks 21+: Final court ruling and enforcement of equitable distribution.

Costs and Fees Related to Marital Funds Disputes

- Attorney fees vary depending on complexity and time investment.

- Costs can increase if there is hidden or disputed property.

- Mediation or arbitration may reduce litigation costs.

- Expert valuations for property or businesses may add fees.

- Prompt and organized documents help reduce unnecessary expenses.

Common Mistakes to Avoid with Marital Funds

- Failing to keep detailed financial records: Document every asset and income to support your claims.

- Mixing separate and marital property: Avoid using separate property funds for marital expenses without documentation.

- Not addressing dissipation early: Investigate any unusual spending or asset transfers promptly.

- Ignoring legal deadlines: Follow the court and attorney’s guidance on timelines for disclosure.

- Underestimating appreciation of separate property: Track increases in value due to marital efforts.

- Delaying legal consultation: Early help from an experienced family law attorney can prevent costly mistakes.

If you only remember one thing: Thorough documentation and early legal advice are key to protecting your marital funds.

Legal Notes for North Carolina and Florida Cases

North Carolina Notes

North Carolina follows equitable distribution under N.C. Gen. Stat. § 50-20. The court examines marital property and factors such as the length of marriage, contributions, and economic circumstances to divide marital funds fairly, not necessarily equally. Courts differentiate between marital and separate property strictly.

Florida Notes

Florida law under Fla. Stat. § 61.075 addresses equitable distribution and classifies assets as marital or non-marital. Florida allows for consideration of passive appreciation of separate property if marital funds were used. Dissipation is also a key factor courts weigh in distributing marital funds in divorce.

Nationwide Concepts

Generally, U.S. states follow either community property or equitable distribution principles. North Carolina and Florida practice equitable distribution, where courts divide assets fairly, which involves characterizing assets and their value during marriage. Laws vary, so local legal advice is crucial.

When to Call a Lawyer About Your Marital Funds

- If you suspect hidden or dissipated assets

- When you need help gathering and organizing financial documents

- At the start of divorce proceedings or before filing

- If your spouse disputes ownership or value of funds

- To protect retirement and pension benefits

- If separate and marital funds are mixed and unclear

- When negotiating settlements and property division

- If complex assets or business valuations are involved

- When facing potential unequal or unfair distribution

- If you want to avoid costly legal mistakes

About Vasquez Law Firm

At Vasquez Law Firm, we combine compassion with aggressive representation. Our motto "Yo Peleo" (I Fight) reflects our commitment to standing up for your rights.

- Bilingual Support: Se Habla Español - our team is fully bilingual

- Service Areas: North Carolina, Florida, and nationwide immigration services

- Experience: Over 15 years helping clients navigate complex legal matters

- Results: Thousands of successful cases across multiple practice areas

Attorney Trust and Experience

Attorney Vasquez holds a Juris Doctor degree and is admitted to practice in both the North Carolina State Bar and Florida Bar. With over 15 years of dedicated legal experience, he has built a reputation for providing personalized attention and achieving favorable outcomes for his clients.

Don't wait to get the help you deserve. Call us now for immediate assistance.

Se Habla Español

Frequently Asked Questions

What is the meaning of marital funds?

Marital funds refer to money and assets acquired during a marriage that are subject to division at divorce. This includes funds earned by either spouse, property purchased during marriage, and benefits such as retirement accounts accumulated during that time.

Is my wife entitled to half my 401k in a divorce?

Generally, the portion of a 401k earned during marriage is treated as marital property in Florida and North Carolina. This means it is subject to equitable distribution. However, the division is not always exactly half but can vary based on factors like contributions and length of marriage.

What assets are protected in a divorce in Florida?

Assets owned prior to marriage, inheritances, and gifts typically classify as separate property in Florida, protected from division. The increase in value of these assets during marriage may still be considered marital property depending on the circumstances.

What happens to property owned before marriage in Florida?

Property owned before marriage is generally separate property and not subject to division. If marital funds were used to improve or maintain the property, or if it appreciated in value during marriage, the increase in value may be shared.

How do courts in North Carolina distribute marital funds?

North Carolina courts apply equitable distribution, dividing marital property fairly but not necessarily equally. Factors include the length of the marriage, financial contributions from each spouse, and economic circumstances post-divorce.

Can marital funds include passive appreciation of property?

In Florida, passive appreciation of non-marital property during marriage can be considered marital property in part. The court evaluates how the increase in value relates to marital efforts or funds.

What is dissipation of marital assets in Florida?

Dissipation refers to the wasteful spending or concealment of marital assets by one spouse, often evaluated during divorce to adjust equitable distribution and ensure fairness for the other spouse.

How can I protect my marital funds during a divorce in Orlando?

Protect your marital funds by maintaining detailed financial records, avoiding dissipation, and consulting an experienced family law attorney early on. Legal guidance can help you understand rights and protect assets.

Sources and References

- North Carolina Courts

- Florida Courts

- U.S. Code on Marital Property

- N.C. Gen. Stat. § 50-20

- Fla. Stat. § 61.075

Take the first step toward justice today. Our team is standing by to help.

Start Your Free Consultation Now

Call us: 1-844-967-3536

Se Habla Español - Estamos aquí para ayudarle.

Free Legal Consultation

Discuss your case with our experienced attorneys. We're available 24/7.

Vasquez Law Firm

Legal Team

Our experienced attorneys at Vasquez Law Firm have been serving clients in North Carolina and Florida for over 20 years. We specialize in immigration, personal injury, criminal defense, workers compensation, and family law.